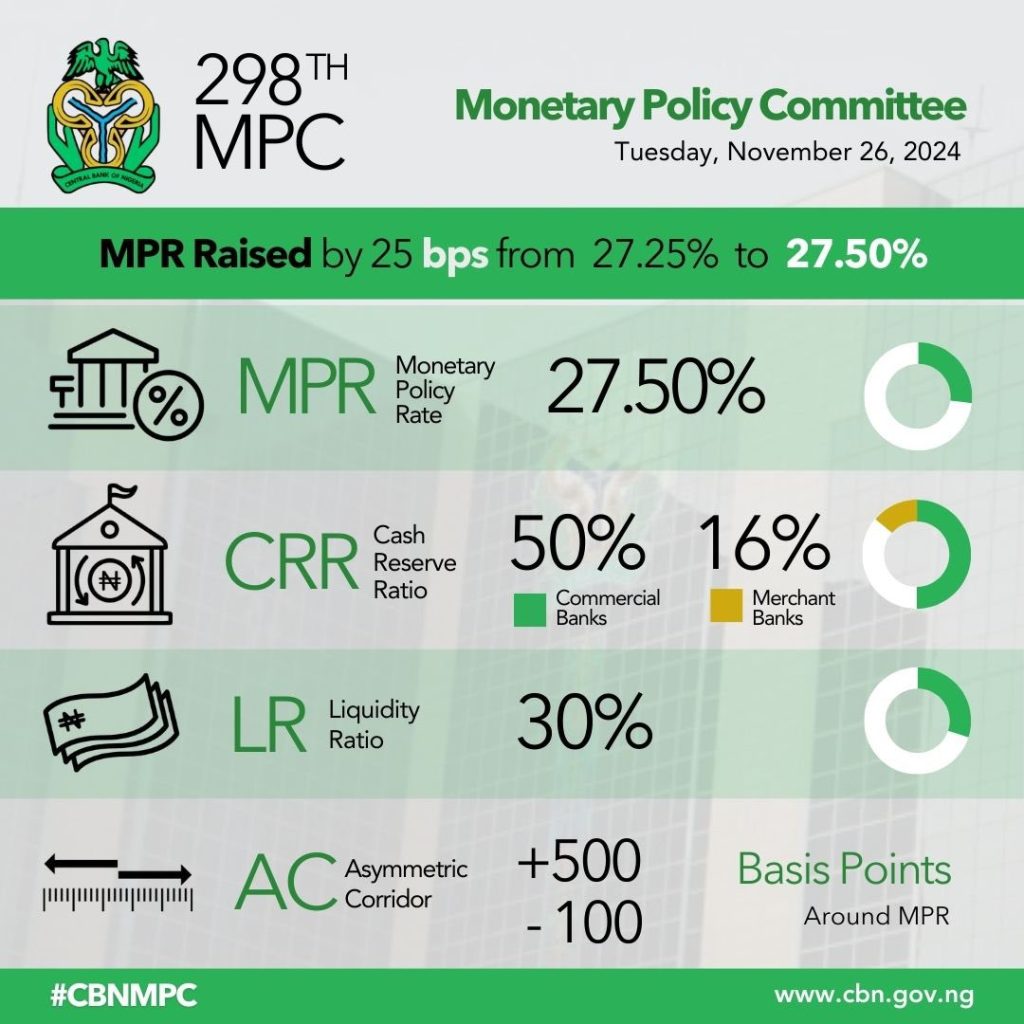

The Central Bank of Nigeria (CBN) has increased the Monetary Policy Rate (MPR) to 27.50% from 27.25%, marking the sixth rate hike this year in its ongoing effort to curb rising inflation. The decision was announced by CBN Governor Yemi Cardoso at the conclusion of the Monetary Policy Committee (MPC) meeting held in Abuja.

Cardoso disclosed that the MPC unanimously agreed to raise the MPR by 25 basis points while maintaining key monetary parameters. The Cash Reserve Ratio (CRR) remains at 50% for Deposit Money Banks and 16% for Merchant Banks, with the Liquidity Ratio held steady at 30%. The Asymmetric Corridor was also retained at +500/-100 basis points around the MPR.

“This decision reflects the committee’s commitment to addressing inflationary pressures and ensuring macroeconomic stability,” Cardoso stated.

The rate hike comes as Nigeria grapples with persistent inflation, driven by high energy costs, supply chain disruptions, and currency depreciation. Analysts predict the increased MPR will tighten liquidity in the financial system, potentially impacting borrowing costs for businesses and individuals.

The latest adjustment aligns with the CBN’s broader strategy to stabilize the economy, although critics warn that the successive rate hikes may strain economic growth and consumer spending.

Market watchers are now looking to see how the new rate will influence inflation trends and economic activity in the coming months.